Home

Other

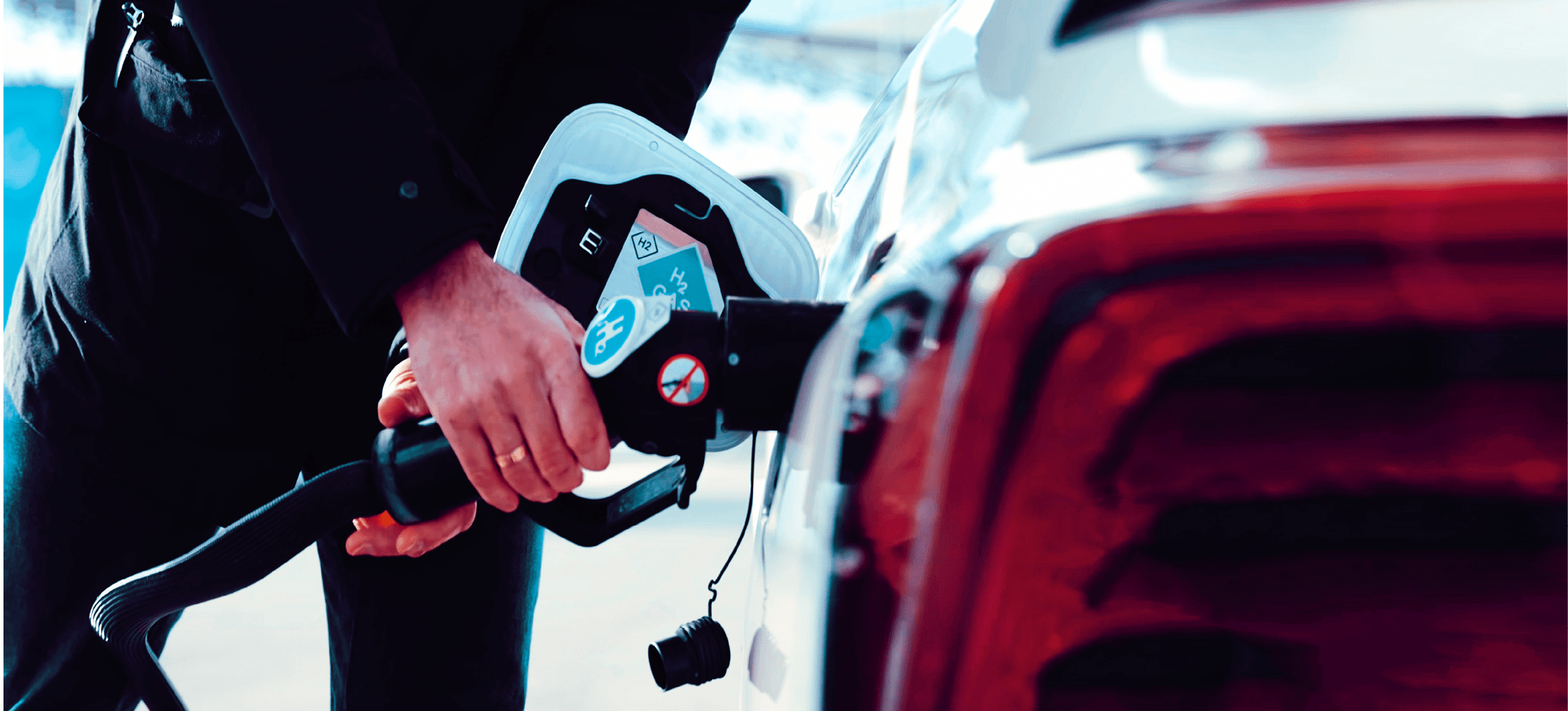

Following the introduction of the revised Renewable Energy Directive (RED III), the government has revealed plans to introduce a support system for hydrogen usage in transport, including heavy transport vehicles.

Several additional reforms are being deliberated, including matters related to taxation, implementing a hydrogen blending mandate for aviation, market oversight and continued execution of RED II and III, along with their associated delegated actions.

Dutch Environment and Planning Act

(Omgevingswet)

This Act will enter into force on 1 January 2024, with implications for permitting and construction of hydrogen projects.

Energy Act

The Dutch legislator is currently working on a new Energy Act, intended to replace the current Electricity Act and Gas Act. At the time of writing (Q4 2023), the draft bill does not encompass any provisions pertaining to hydrogen. In the accompanying explanatory documentation, the government highlights that the European Commission issued proposals in December 2021 to revise the Gas Directive and Gas Regulation, both of which encompass discussions about hydrogen. Consequently, the government has adopted a policy-neutral stance towards numerous gas-related topics. Consequently, the proposal refrains from endorsing the shift towards hydrogen, but proposes the Act will necessitate amendments at the appropriate time.

No specific hydrogen legislation has been put in place in the Netherlands to date.

At present, existing laws governing gas regulation, as well as those pertaining to the energy, transportation and heating sectors are applied to hydrogen.

In autumn 2022, two hydrogen safety guidelines for the built environment were published by the Ministry of Economic Affairs:

A generic guideline for dealing with hydrogen safety risks in the energy transition; and

A generic guideline for dealing with hydrogen safety risks in the energy transition; and

An additional safety guideline for the four hydrogen pilots for heating homes in the built environment.

An additional safety guideline for the four hydrogen pilots for heating homes in the built environment.

These guidelines provide interpretation and guidance in situations where the current legal regime is unclear or incomplete.

On 14 September 2021, the Dutch Authority for Consumers and Markets (ACM) released a guideline to offer clarity on the role of network companies in the market for alternative energy carriers, such as hydrogen.

Under the current legal framework, network companies are authorised to undertake the following actions or activities related to alternative

energy carriers:

Installation and management of transmission pipelines and related resources for alternative energy carriers, facilitating the transportation of these carriers across this infrastructure.

Installation and management of transmission pipelines and related resources for alternative energy carriers, facilitating the transportation of these carriers across this infrastructure.

Construction and maintenance of production facilities for alternative energy carriers on behalf of third parties (ownership and management rights are excluded).

Construction and maintenance of production facilities for alternative energy carriers on behalf of third parties (ownership and management rights are excluded).

Engagement in production, trade and distribution of alternative energy carriers by network companies is generally prohibited. Exceptions apply where these activities are inherently tied to infrastructure, or carried out through minority stakes and collaborative ventures without imposing decisive control of the network company.

Engagement in production, trade and distribution of alternative energy carriers by network companies is generally prohibited. Exceptions apply where these activities are inherently tied to infrastructure, or carried out through minority stakes and collaborative ventures without imposing decisive control of the network company.

Network companies have the opportunity to play a more significant role in shaping alternative energy carrier markets through collaborations like minority stakes and joint ventures, promoting development in partnership with other entities – a form of public-private cooperation.

The Netherlands views hydrogen as an essential component in achieving its climate goals and in transitioning to a sustainable energy system.

The Dutch government has set out its national strategy on hydrogen and corresponding policy agenda in its letter dated March 2020 (and updated in December 2022 and spring 2023). This is also referred to as the Dutch National Hydrogen Programme (Nationaal Waterstof Programma) or the Hydrogen Strategy.

The government's objective is to realise:

500 megawatts of electrolysis capacity by 2025;

500 megawatts of electrolysis capacity by 2025;

4 gigawatts by 2030; and

4 gigawatts by 2030; and

8 GW by 2032, largely powered by offshore wind.

8 GW by 2032, largely powered by offshore wind.

Several projects are already underway or in planning stages. For instance, the "Hydrogen Valley" project in the Northern Netherlands, supported by the European Commission, aims to establish a fully functioning green hydrogen value chain in the region.

Major Dutch ports like Rotterdam, North Sea Port (Vlissingen and Terneuzen, excluding Ghent), Groningen Seaports (Delfzijl and Eemshaven) and Amsterdam are also investing in hydrogen infrastructure.

The National Climate Agreement between the government, industry and other stakeholders in 2019 sets out ambitious targets for hydrogen in terms of upscaling, cost reduction and innovation.

Key legislation

Key regulatory bodies

A number of general reforms will have implications for the hydrogen market in the Netherlands:

Anticipated near-term regulatory changes

DEI+ (GroenvermogenNL): A scheme focusing on innovation and scaling up hydrogen projects for energy transition and green chemistry. Investments include R&D, pilots, demonstration projects, and human capital, including education. The scheme allocated a budget of €40 million for 2023.

DEI+ (GroenvermogenNL): A scheme focusing on innovation and scaling up hydrogen projects for energy transition and green chemistry. Investments include R&D, pilots, demonstration projects, and human capital, including education. The scheme allocated a budget of €40 million for 2023.

Scaling up Scheme (OWE): An investment subsidy for hydrogen production through electrolysis (0.5 – 50 MW input power). The scheme allocated a budget of €245.6 million in 2023.

Scaling up Scheme (OWE): An investment subsidy for hydrogen production through electrolysis (0.5 – 50 MW input power). The scheme allocated a budget of €245.6 million in 2023.

SDE++: An operational subsidy aimed at the large-scale deployment of techniques producing renewable energy and other technologies that reduce CO2 emissions. The scheme allocated a budget of €8 billion in 2023.

SDE++: An operational subsidy aimed at the large-scale deployment of techniques producing renewable energy and other technologies that reduce CO2 emissions. The scheme allocated a budget of €8 billion in 2023.

Hydrogen in Mobility: The RVO, in collaboration with the Ministry of Infrastructure and Water Management, is preparing a new subsidy scheme focusing on logistics and heavy road transport. The scheme will be published in 2024.

Hydrogen in Mobility: The RVO, in collaboration with the Ministry of Infrastructure and Water Management, is preparing a new subsidy scheme focusing on logistics and heavy road transport. The scheme will be published in 2024.

The EU Innovation Fund/Hydrogen Bank is an EU-level fund aiming to bridge the cost gap between green hydrogen and hydrogen production based on carbon-emitting fossil fuels, with hydrogen producers invited to bid for financial support based on their anticipated production of green hydrogen.

The EU Innovation Fund/Hydrogen Bank is an EU-level fund aiming to bridge the cost gap between green hydrogen and hydrogen production based on carbon-emitting fossil fuels, with hydrogen producers invited to bid for financial support based on their anticipated production of green hydrogen.

As part of the DEI+, the so called National Growth Fund Programme,

"Green Power of the Dutch Economy" (GroenvermogenNL), aims to boost

the green hydrogen sector in the Netherlands by focusing on:

Large-scale hydrogen projects;

Large-scale hydrogen projects;

Research and development; and

Research and development; and

Enhancing knowledge and skills through education and retraining.

Enhancing knowledge and skills through education and retraining.

The emerging hydrogen industry lacks a dedicated regulatory entity. Instead, various regulators assume responsibilities based on the specific activities involved.

Local Authorities, Municipalities and Provinces: Governs land use and conducts environmental impact assessments.

Local Authorities, Municipalities and Provinces: Governs land use and conducts environmental impact assessments.

State Supervision of the Mines (Staatstoezicht op de Mijnen (SodM)): Pertains to hydrogen storage.

State Supervision of the Mines (Staatstoezicht op de Mijnen (SodM)): Pertains to hydrogen storage.

National Office for road traffic (Rijksdienst Wegverkeer): Grants approval for hydrogen transport vehicles.

National Office for road traffic (Rijksdienst Wegverkeer): Grants approval for hydrogen transport vehicles.

Minister of Economic Affairs: Regulates new pipelines and decommissioning.

Minister of Economic Affairs: Regulates new pipelines and decommissioning.

Authority for Consumers and Markets Autoriteit Consument & Markt (ACM): Regulates the gas network.

Authority for Consumers and Markets Autoriteit Consument & Markt (ACM): Regulates the gas network.

Netherlands Enterprise Agency (Rijksdienst voor Ondernemend Nederland (RVO)): Provides certain subsidies and other financial support programmes.

Netherlands Enterprise Agency (Rijksdienst voor Ondernemend Nederland (RVO)): Provides certain subsidies and other financial support programmes.

The Dutch government website spells out requirements for accessing each support scheme.

Access to the DEI+ requires applicants to be:

Companies located in the Netherlands or the Dutch Caribbean, including Bonaire, St. Eustasius, and Saba;

Companies located in the Netherlands or the Dutch Caribbean, including Bonaire, St. Eustasius, and Saba;

An individual enterprise that carries out a project at its own expense and risk; and/or

An individual enterprise that carries out a project at its own expense and risk; and/or

A participant in a collaboration that includes at least one enterprise – provinces and municipalities are allowed to participate in projects but cannot receive subsidies themselves.

A participant in a collaboration that includes at least one enterprise – provinces and municipalities are allowed to participate in projects but cannot receive subsidies themselves.

Similar to other subsidies for renewable energy, it is probable that support mechanisms will be gradually reduced as hydrogen projects become economically self-sufficient.

Accessing support schemes

A standardised template for an HPA has yet to be established in the Netherlands.

At present, HPAs are non-regulated contracts containing generic elements of sale and purchase agreements for goods.

Key specific issues to be addressed in the HPA include the quality of the hydrogen to be delivered, specifics of the hydrogen production facility, the delivery point in view of transfer of title to the hydrogen, measurement of quantities of hydrogen to be delivered and means of transport to the delivery point, i.e. via a pipeline or tube trailer or ex-works the hydrogen facility

As with other commodities, hydrogen may be sold in one-time transactions (spot sales) for immediate delivery, however a spot market for hydrogen has yet to emerge in the Netherlands.

Given the infrastructure investment required for hydrogen production and distribution, many players may opt for long-term agreements on fixed or flexible pricing models.

In situations where one party has access to raw materials or production capabilities but not the means to produce hydrogen, they might engage in a tolling agreement.

Provided hydrogen becomes a major energy source, public procurement processes might be introduced, which will bring its own tendering arrangements.

The main selling opportunities for hydrogen in the Netherlands are as follows:

Energy: Hydrogen can act as a buffer for surplus renewable energy, making it essential for grid balancing and storage.

Energy: Hydrogen can act as a buffer for surplus renewable energy, making it essential for grid balancing and storage.

Transport: The Netherlands envisions a significant role for hydrogen in decarbonising heavy transport, including trucks, buses, and potentially maritime applications.

Transport: The Netherlands envisions a significant role for hydrogen in decarbonising heavy transport, including trucks, buses, and potentially maritime applications.

Industry: The Dutch industrial sector, especially petrochemicals and heavy industries in regions like Rotterdam, is looking at hydrogen as a replacement for natural gas and as a raw material.

Industry: The Dutch industrial sector, especially petrochemicals and heavy industries in regions like Rotterdam, is looking at hydrogen as a replacement for natural gas and as a raw material.

Built environment: Hydrogen is being explored for heating in residential and commercial buildings, especially in areas where electrification is challenging.

Built environment: Hydrogen is being explored for heating in residential and commercial buildings, especially in areas where electrification is challenging.

Agriculture: Under the Hydrogen Strategy and its accompanying support schemes, the agricultural sector has initiated pilot projects involving hydrogen, in particular powering heavy machinery and trucks serving agro-logistics.

Agriculture: Under the Hydrogen Strategy and its accompanying support schemes, the agricultural sector has initiated pilot projects involving hydrogen, in particular powering heavy machinery and trucks serving agro-logistics.

Ports and logistics: The major Dutch ports are aiming to become international hubs for the production, uptake and transit of hydrogen and hydrogen-derived products.

Ports and logistics: The major Dutch ports are aiming to become international hubs for the production, uptake and transit of hydrogen and hydrogen-derived products.

All the major heavy industries and energy production sectors are covered by the EU-ETS.

Selling opportunities

Hydrogen purchase agreements (HPAs) in the Netherlands

On the legal side, as the hydrogen industry grows, the licensing, distribution, and sales of hydrogen will require adherence to licences and permits, and align with developing health, safety, and environmental norms.

Any HPA will need to address the term, buyer and seller's obligations, description of the hydrogen facilities, hydrogen quantities to be delivered and their measurement, the delivery point, title and risk transfer, contract price, nomination of hydrogen, quality specifications, means of transport to the delivery point and security and insurance.

In addition, more specific HPA issues such as take or pay obligations, guarantees of origin and tax issues may need to be addressed.

Commercial issues include pricing, delivery timelines, quality benchmarks, warranties, indemnifications, liability clauses, mechanisms for resolving disputes, invoicing and payment, force majeure, change in applicable law, termination and confidentiality.

Key legal and commercial issues in HPAs in the Netherlands

Regulatory requirements for hydrogen energy installations and electrolysers

Support schemes

Selling hydrogen in

the Netherlands

The National Climate Agreement between the government, industry and other stakeholders in 2019 sets out ambitious targets for hydrogen in terms of upscaling, cost reduction and innovation.